|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Lowest APR Home Loan Options: Insights and TipsUnderstanding APR in Home LoansThe Annual Percentage Rate (APR) is a crucial factor when evaluating home loans. It represents the annual cost of borrowing, including interest rates and additional fees, providing a comprehensive view of the loan's cost. Why APR MattersAPR helps borrowers compare different loan options more effectively. A lower APR can lead to significant savings over the life of the loan.

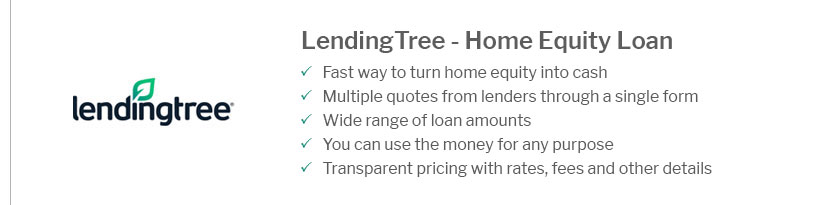

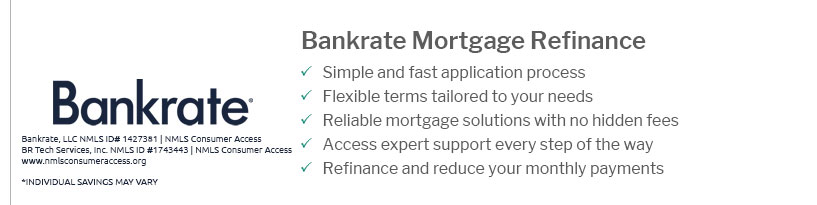

Finding the Best APR DealsSecuring the lowest APR home loan requires research and comparison. Here are some strategies to help: Research and Compare

Improve Your Credit ScoreYour credit score plays a significant role in determining your APR. Improving your score can lead to better loan offers.

Types of Home Loans with Low APRDifferent loan types may offer varying APRs. Understanding these can help in making informed decisions. Fixed-Rate vs. Adjustable-Rate MortgagesFixed-rate mortgages offer stability with a constant APR, while adjustable-rate mortgages may start lower but can fluctuate. Government-Backed LoansLoans such as FHA, VA, and USDA can offer competitive APRs. If you're in the Southeast, exploring home loans in georgia might reveal beneficial options. Frequently Asked QuestionsWhat factors influence the APR on a home loan?Several factors can influence the APR, including the borrower's credit score, the loan amount, the down payment, and the type of loan chosen. How can I lower the APR on my home loan?Improving your credit score, shopping around for the best rates, and considering a larger down payment are effective ways to lower the APR on your home loan. Are there any drawbacks to focusing only on APR?Yes, while APR is an important factor, it should not be the sole consideration. Borrowers should also consider the loan terms, monthly payments, and overall financial stability. https://www.zillow.com/mortgage-rates/

... lowest mortgage rate, APR, and projected principal and interest payment. Then review the Origination Charges located on the Loan Estimate under Loan Costs ... https://themortgagereports.com/65972/the-best-mortgage-rates-lender-rankings

According to The Mortgage Reports' lender network, the lowest mortgage rates as of January 2025 are 7.042% (7.088% APR) for a 30-year fixed-rate ... https://www.bankofamerica.com/mortgage/mortgage-rates/

Rate 6.625% ; APR 7.068% ; Points 0.725 ; Monthly Payment $1,281.

|

|---|